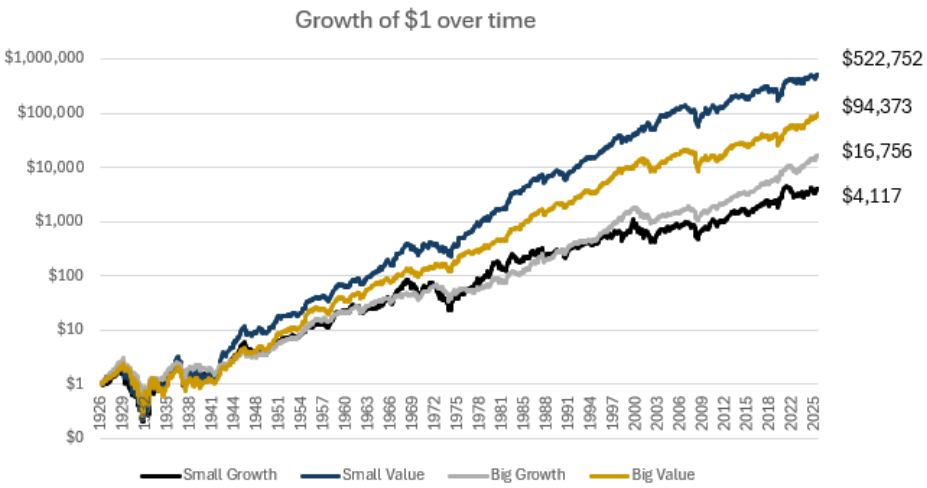

Over very long periods of time, research shows that value investing has substantially outperformed growth, with the smaller-cap stocks providing the largest upside. (see chart below).

The reason why value strategies tend to outperform over the long-term includes lower starting valuations offering more room for re-ratings, dividend yields are higher, and downside risk is mitigated with a larger margin of safety during periods of volatility. In small caps, this effect is amplified as smaller companies are typically able to grow faster than their larger peers. In addition, there is a higher risk premium – a reward for owning more illiquid stocks. However, this dynamic has been less evident in recent years, given the outsized impact of mega-cap tech leaders – more on that later!

Definitions of “value and growth” vary. For the chart below, stocks trading on a low price-to-book multiples are classified as value, while those with high price-to-book multiples are classified as growth. The data is based on performance of the US market as this is the only market with enough data points to make meaningful comparisons.

The outperformance of small-cap value stocks over the long run is very clear.

Source: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

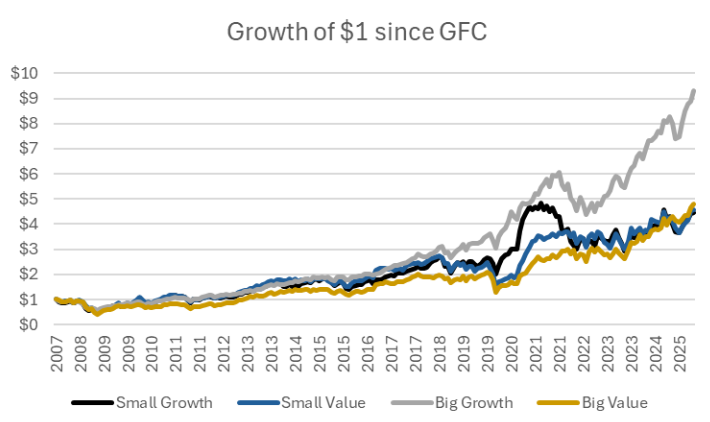

The market run since about 2018 has seen some spectacular rises, particularly in growth mega-caps in the US. The price rises in these large stocks has flipped the traditional narrative of small value stocks outperforming completely on its head. Key drivers of recent growth outperformance the past decade include the rise of passive investing, increased retail flows into familiar large-cap names, AI-driven enthusiasm, and strong earnings from the ‘Magnificent Seven’. A similar gap has opened between small and large caps in Australia, where super funds have been pulling capital from smaller companies to avoid jeopardising their performance against the MySuper Test which uses the ASX300 as a benchmark.

Source: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Hindsight is amazing when investing and everything is easy to explain when you know the outcome but as investors we must decide where to invest our money in real time. We now must ask: are we in a “new normal,” where large tech stocks keep outperforming indefinitely on themes like AI and big data, or will returns eventually meanrevert, making the small-cap end of the market the more attractive place to allocate capital?

In competitive markets, any company earning margins above the industry norm inevitably attracts competitors who imitate or improve its products to capture those excess profits. No firm has ever maintained a decisive edge forever. Sustaining superior margins across cycles demands continuous, heavy investment in areas like marketing and R&D just to stay ahead. It is in this context that we look at the large tech stocks that have dominated recently.

Barriers to entry in AI software appear low: there are numerous competitors including ChatGPT, Gemini, Copilot, DeepSeek, Perplexity, Claude and many others, offering powerful tools, often for free. At the infrastructure level, annual AI-related capex is estimated at around US$572bn this year and US$763bn by 2026, largely directed into data centres. Yet there is little to suggest that one data centre operator has a durable structural advantage over another. The business model for monetising AI remains unproven. When so many capable providers give away or heavily subsidise access, sustaining high margins across the industry looks difficult.

Nvidia is arguably the most important stock in the S&P 500 and currently dominates AI semiconductors with a clear product edge. But it faces a deep bench of well-capitalised rivals—AMD, Intel, Alphabet, Microsoft, Amazon, Apple, Qualcomm, Broadcom and others—all investing aggressively to narrow the gap. To stay ahead, Nvidia must pour enormous sums into R&D, with no assurance that a competitor will not achieve a breakthrough that erodes its lead.

Put simply, there is enormous excitement around AI “fairy dust,” but it is unlikely the entire ecosystem will enjoy enduring supernormal profits. Competitive forces will intensify as the industry matures, and we believe that makes today’s AI valuations hard to justify.

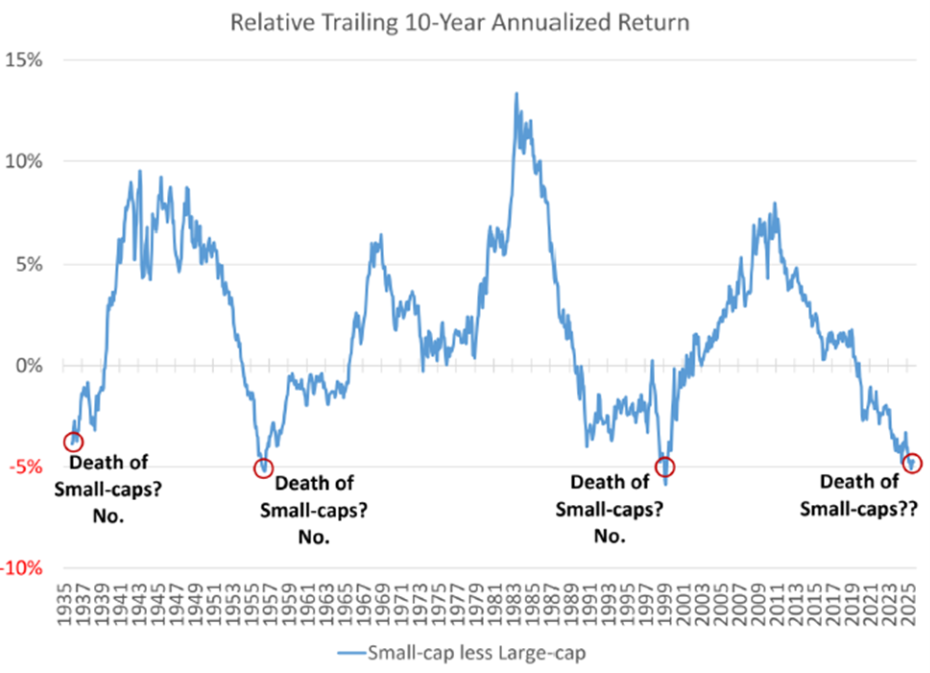

If our thesis is true, then it is likely that investors will eventually be disappointed by the returns that large tech companies produce and will look for alternate places to invest their money such as small cap value stocks. Based on the chart below we believe that the next decade may be one of the strongest periods for small-cap investors.

Source: Furey Research Partners, Factset as of 30/09/2025

With the above information in mind, we have been looking outside the ASX300 to find some of the most undervalued opportunities. One of our biggest positions that we think has enormous upside potential is Fleetwood Limited (FWD:ASX). Fleetwood operates three business units

Building Solutions – one of Australia’s largest national modular builders

Community Solutions – owns and manages a fly-in-fly-out hotel in Karratha, WA and manages a similar facility in Port Hedland, WA

RV solutions – supplies parts, accessories and services to the recreational vehicle market

Earnings at Fleetwood are growing quickly with robust demand for their FIFO hotel in the booming Karratha region and strong tailwinds in modular building as governments are starting to embrace a quick to market solution for social housing, schools and prisons.

Fleetwood currently has a market capitalisation of $230 million, net cash of $50 million and is expected to make over $25 million in net profit after tax this year which will be paid out as a dividend. Looking at a list of the companies in the ASX300 we find it hard to find any opportunities with the same valuation metrics.

We believe that buying overlooked stocks like Fleetwood that sit outside the major indices is the best way to achieve long-term outperformance in the coming years.

This does not constitute a recommendation to purchase, redeem or sell any financial product(s). In considering the content of the article, note that past investment performance is not indicative of future investment performance. Before making an investment decision based on this document, the reader must consider whether it is personally appropriate in light of their financial circumstances or should seek financial advice on its appropriateness. Financial conclusions and advice are reasonably held at the time of completion but are subject to change without notice. WW assumes no obligation to update this article following publication. Except for any liability which cannot be excluded, WW and each of its officers, employees, and professional advisors disclaim all liability for any error or inaccuracy in, misstatement, or omission from, this article or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.